Nobel Prize Winnings

Nobel Prize 2023: Increased Prize Amount Highlights Prestigious Legacy

According to the Nobel Foundation, the 2023 Nobel Prize amount has been raised to 11 million Swedish kronor per category.

A Financial Commitment to Excellence

To begin with, this increase, equivalent to approximately $986,270, reflects the foundation’s commitment to maintaining the prestige and significance of the awards. Over the years, the Nobel Prize has recognized outstanding achievements in fields like physics, chemistry, and medicine. Learn more about the Nobel Prize’s history on NobelPrize.org.

Ensuring Financial Viability

Additionally, the decision underscores efforts to ensure the financial sustainability of the prizes. The foundation continually adjusts award amounts based on economic conditions, securing its global reputation.

Encouraging Innovation and Excellence

Moreover, the increased prize amount aims to inspire scientists, writers, and humanitarians to pursue groundbreaking work. It reinforces the Nobel Prize’s role in advancing knowledge and innovation. Explore recent winners and their contributions on the Nobel Prize official site.

Acknowledging Global Impact

Notably, the Nobel Prize continues to shape global discourse, celebrating contributions that transform society. With this adjustment, the foundation reinforces the awards as a symbol of excellence and progress.

Learn More

In conclusion, the 2023 Nobel Prize increase highlights the enduring importance of recognizing exceptional achievements. Discover more about past and current laureates on NobelPrize.org. This prestigious tradition continues to inspire change and innovation worldwide.

Historical Fluctuations in Prize Value

The Evolution of the Nobel Prize Amount: A Reflection of Economic Trends

The Nobel Prize amount has undergone notable fluctuations since its establishment in 1901, mirroring economic shifts and financial strategies.

The Early Years: Modest Beginnings

Initially, the prize was valued at 150,782 Swedish kronor, equivalent to 8.8 million kronor in today’s terms. However, economic instability during the early 20th century led to significant declines in real value, reaching its lowest point in 1919. Learn more about the Nobel Prize’s history on NobelPrize.org.

Mid-Century Stability

From the 1940s to the mid-1980s, the prize amount remained relatively stable. Despite nominal increases, inflation eroded its real value. This period reflected the foundation’s focus on maintaining financial sustainability while navigating post-war economic challenges.

Late 20th Century Increases

In contrast, the late 20th century marked dramatic increases in prize value. By 2001, the amount peaked at 10 million kronor, symbolizing the award’s growing global prestige. For insights into this era, visit the Nobel Prize archives.

Strategic Adjustments for Sustainability

However, in 2012, the prize amount was reduced by 20%, lowering it to 8 million kronor. This decision was made to ensure the long-term sustainability of the foundation’s endowment.

Recent Trends: Renewed Growth

In recent years, the prize amount has steadily increased, reaching 11 million kronor for 2024. This reflects the foundation’s confidence in its financial management and commitment to recognizing groundbreaking achievements.

A Legacy of Adaptation

The Nobel Prize’s evolution highlights its ability to adapt to changing economic conditions while maintaining its global significance. Explore more about the Nobel Prize’s financial history on NobelPrize.org.

Investment Strategies of Nobel Endowment

The Nobel Foundation’s Investment Strategy: Balancing Growth and Sustainability

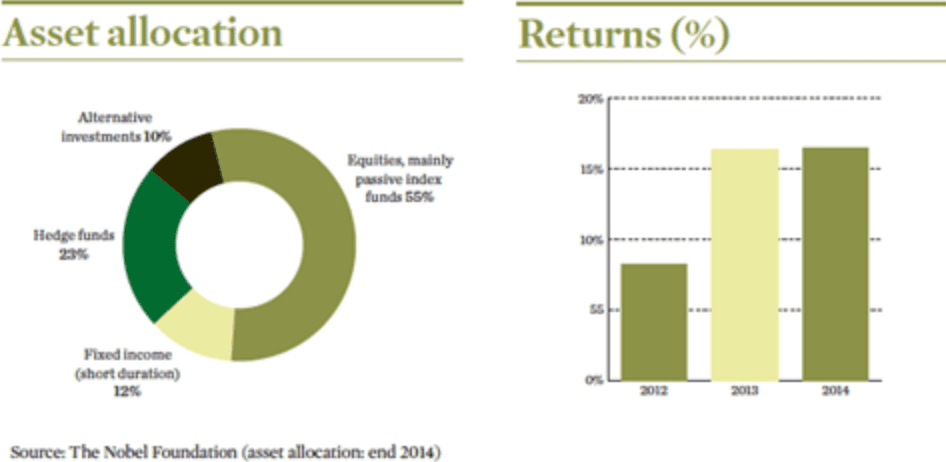

The Nobel Foundation employs a strategic approach to investments, aiming for a 3% real annual return while safeguarding its assets.

A Diversified Portfolio

To achieve this goal, the foundation maintains a diversified portfolio comprising:

- 53% equities for long-term growth.

- 22% hedge funds, offering stability and as alternatives to low-yielding fixed-income assets.

- 17% fixed-income and cash for liquidity and risk management.

- 9% property and infrastructure for steady returns.

This allocation reflects a carefully balanced strategy, prioritizing growth and stability. Learn more on the Nobel Foundation website.

Evolving Investment Philosophy

Initially, Alfred Nobel stipulated investing in “safe securities.” Over time, the foundation adopted a more flexible interpretation to adapt to changing economic conditions. This evolution enables investments across diverse asset classes, ensuring sustainability and resilience.

Hedge Fund Allocation

Interestingly, the foundation’s 25% allocation to hedge funds is higher than typical institutional investors. This approach offsets the challenges posed by low-yield fixed-income options, ensuring steady performance.

Ethical Investment Commitment

Moreover, the Nobel Foundation incorporates environmental, social, and governance (ESG) factors into its strategy. It adheres to the UN Principles for Responsible Investment, reinforcing its commitment to ethical practices. For more on ESG, visit PRI’s official site.

Impressive Returns

Over the past five years, the foundation’s investment capital has grown by 7.5% annually, showcasing the success of its strategic approach. This performance underpins the foundation’s ability to maintain the Nobel Prize’s prestige and financial viability.

A Legacy of Sustainable Growth

In conclusion, the Nobel Foundation’s investment strategy reflects a balance of innovation, diversification, and ethical commitment. This approach ensures the longevity of Alfred Nobel’s vision while adapting to modern financial challenges. Explore their financial principles further on NobelPrize.org.

Notable Spending by Laureates

How Nobel Laureates Spend Their Prize Money: A Mix of Practicality and Passion

Nobel laureates have used their prize money in diverse ways, from practical investments to indulgent and creative pursuits.

Practical Investments

To begin with, many winners allocate their funds to everyday expenses. Common uses include paying off mortgages, financing children’s education, or saving for the future. Such choices highlight the real-life impact of the prize. Learn more about laureates’ personal journeys on NobelPrize.org.

Funding Scientific Research

Additionally, some laureates reinvest their winnings into scientific pursuits. For instance, Marie and Pierre Curie used their 1903 physics prize to further their groundbreaking research in radioactivity.

Charitable Contributions

Many recipients channel their winnings into charitable endeavors. John Mather, the 2006 physics laureate, donated his prize money to support scientific education through his foundation. For more on his work, visit NASA.

Indulgent Purchases

On a lighter note, some laureates splurge on unique purchases:

- Richard Roberts (1993 medicine) built a croquet lawn.

- Sir Paul Nurse (2001 medicine) bought a high-end motorbike.

- Franco Modigliani (1985 economics) upgraded his sailboat, indulging his passion for sailing.

Cultural Contributions

Moreover, Nobel funds often inspire cultural projects. Orhan Pamuk, 2006 literature winner, established the Museum of Innocence in Istanbul, blending art and literature. Explore the museum’s details on Orhan Pamuk’s site.

Taxation and Shared Prizes

It’s important to note that Nobel prize money is often shared among winners and subject to taxation, reducing the net amount available for personal or philanthropic use.

A Reflection of Individual Values

In conclusion, Nobel laureates’ spending reflects a balance of practical needs, passionate indulgences, and generous contributions. Their choices demonstrate how the prize can fuel personal and global impact. For more stories about laureates, explore NobelPrize.org.